Global Fleet Management Market: Driving the Future of Smart, Sustainable Mobility (2024–2032)

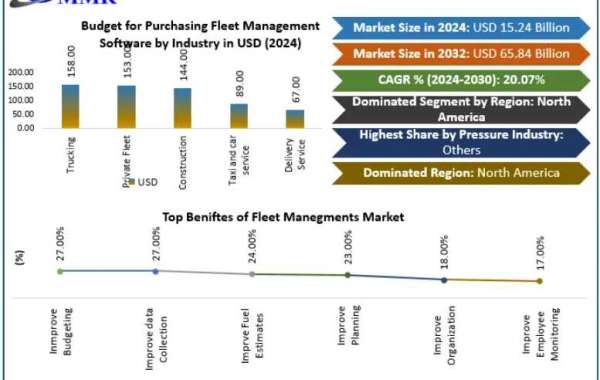

The Global Fleet Management Market is witnessing unprecedented growth, valued at USD 15.24 billion in 2024 and projected to reach nearly USD 65.84 billion by 2032, expanding at a CAGR of 20.07%. As organizations worldwide prioritize efficiency, safety, and sustainability in logistics and mobility operations, fleet management has evolved into a vital component of modern transportation ecosystems.

Market Overview

Fleet management refers to the comprehensive oversight of a company’s vehicle fleet, encompassing procurement, maintenance, fuel optimization, driver management, regulatory compliance, and overall operational efficiency. The shift toward data-driven, AI-powered, and connected vehicle solutions is transforming traditional fleet operations into intelligent, predictive, and sustainable systems.

With the global logistics and transportation sectors increasingly dependent on real-time insights, telematics, and automation, fleet management is now at the forefront of digital transformation. The industry’s expansion is further accelerated by the rapid adoption of electric vehicles (EVs), advancements in IoT technologies, and a growing emphasis on green mobility.

Gain insights into the most attractive segments — click here to receive a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29184/

Key Market Dynamics

1. Operational Efficiency as a Core Driver

Businesses are investing heavily in fleet management solutions to cut costs and enhance productivity. Advanced telematics and analytics tools enable route optimization, driver performance tracking, and predictive maintenance—helping companies reduce fuel consumption and extend vehicle lifespan. Fleet operators leveraging such technologies report up to 20% reduction in operational costs and 25% improvement in fleet uptime.

2. Telematics and IoT Integration

More than 70 million vehicles globally are equipped with telematics systems as of 2023—a figure expected to double by 2028. These systems utilize IoT sensors, GPS tracking, and AI-based analytics to provide real-time visibility into vehicle performance, driver behavior, and asset utilization. This integration enhances safety, compliance, and cost-efficiency while enabling predictive insights.

3. Rise of Electric and Autonomous Fleets

The global shift toward sustainable transport is accelerating EV adoption among commercial fleets. Fleet operators are investing in EV-compatible software, battery monitoring, and charging infrastructure management systems to comply with emission norms, such as the EU’s target to cut CO₂ emissions by 55% by 2030. Additionally, autonomous vehicle technologies are beginning to reshape logistics by reducing driver dependency and optimizing long-haul transportation.

4. Cybersecurity and Data Privacy Concerns

The exponential growth in connected vehicle data brings heightened risks of cyber threats. Sensitive information—such as driver identities, routes, and vehicle diagnostics—makes fleets potential targets for cyberattacks. Consequently, fleet operators are focusing on robust cybersecurity frameworks and data encryption protocols to mitigate privacy risks and ensure compliance with global data protection standards.

5. Mobility-as-a-Service (MaaS) Revolution

Urbanization and the rise of shared mobility are driving the adoption of MaaS-based fleet models, which combine vehicle sharing, ride-hailing, and logistics into unified digital platforms. This evolution allows fleet managers to monetize idle vehicles, optimize utilization rates, and reduce environmental footprints. MaaS integration is also reshaping service offerings—from leasing models to subscription-based mobility.

Emerging Trends in the Fleet Management Market

AI and Predictive Analytics: Enhancing decision-making by forecasting maintenance needs and optimizing fleet deployment.

Remote Fleet Operations: Driven by hybrid work models and pandemic-era digitalization, remote tracking and assignment management are becoming standard practice.

5G Connectivity: Enabling ultra-fast communication, low latency, and seamless integration between fleets and control centers.

In-Cab Safety Systems: AI-enabled driver monitoring and video telematics to improve driver safety and compliance.

Data-Centric Management: Increased emphasis on leveraging big data for route planning, utilization, and real-time logistics decision-making.

Segment Analysis

By Component

Solutions (64.43% market share, 2024):

Includes telematics, routing software, maintenance tracking, and analytics platforms. The segment continues to dominate as enterprises prioritize automation and data intelligence.Services:

Managed and professional services such as consulting, integration, and maintenance support contribute significantly to fleet optimization and compliance.

By Fleet Type

Passenger Cars:

Represent the larger market share due to growing adoption in corporate leasing and mobility services. Fleet management solutions help track utilization, licensing, fuel efficiency, and maintenance for passenger vehicles.Commercial Fleets:

Encompass trucks, delivery vans, and logistics vehicles essential for e-commerce and goods transportation, particularly in North America and Asia-Pacific.

By Industry

Logistics and Transportation: Core drivers of demand, leveraging real-time analytics for route optimization and delivery accuracy.

Manufacturing and Oil Gas: Utilize fleets for equipment, material, and workforce transport, requiring advanced compliance and maintenance tools.

Chemical and Others: Depend on safety-centric and regulatory-compliant vehicle tracking systems.

Regional Insights

North America:

Leads the global market, supported by high telematics adoption, strict safety regulations, and strong participation from OEMs such as Ford, GM, and Fiat Chrysler. The U.S. Department of Homeland Security’s adoption of fleet telematics exemplifies the region’s technological maturity.Europe:

Witnesses strong growth due to EU environmental regulations, urban fleet electrification, and expansion of EV charging networks.Asia-Pacific:

Expected to record the fastest CAGR, driven by expanding e-commerce, industrial growth, and government incentives for EV adoption in China, India, and Japan.Latin America Middle East Africa (MEA):

Growing infrastructure investments and digitization efforts are opening new opportunities, particularly in logistics and mining fleets.

Gain insights into the most attractive segments — click here to receive a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29184/

Competitive Landscape

The global fleet management market is highly competitive yet fragmented, featuring established telematics leaders and fast-growing start-ups focused on AI and EV technologies.

Key Market Players Include:

Geotab (Canada)

Trimble (US)

Verizon Connect (US)

Mix Telematics (South Africa)

Samsara (US)

Holman (US)

Bridgestone Group (Japan)

Michelin (France)

Fleetcomplete (Canada)

Inseego (US)

Teletrac Navman (US)

ClearpathGPS (US)

Chevin (UK)

Orbcomm (US)

Fleetroot (UAE)

These companies are investing in AI-driven fleet analytics, real-time telematics, and EV management platforms to enhance competitiveness. Strategic acquisitions, like Fleetio’s purchase of Auto Integrate in 2025, highlight the industry’s consolidation and innovation race.

Future Outlook

As the world transitions toward connected, autonomous, shared, and electric (CASE) mobility, the fleet management market will play a pivotal role in enabling this transformation. From urban logistics to long-haul transportation, AI-powered and electrified fleets are set to redefine the future of mobility.

By 2032, fleets will not only transport goods and people efficiently but also serve as digital ecosystems generating valuable insights for predictive operations, sustainability optimization, and safety compliance.

Conclusion

The Global Fleet Management Market stands at the crossroads of technological innovation and environmental responsibility. With its rapid evolution driven by digitalization, telematics, and sustainability goals, the sector offers immense opportunities for investors, technology providers, and mobility operators. Companies that embrace AI integration, EV transition, and cybersecurity will be best positioned to thrive in this high-growth, future-ready industry.